They don’t take into account future growth or profitability. Levered and unlevered cash flow only consider a company’s current financial situation. This can make it difficult to compare companies with different capital structures. For example, they exclude debts that are in the form of equity. As such, it’s important to take this limitation into account when making financial decisions.Īnother limitation of these metrics is that they don’t consider all forms of debt. This data can be subject to interpretation and may not always be accurate. One of the primary limitations of both is that they both rely on accounting data.

UNLEVERED TO LEVERED CASHFLOWS FREE

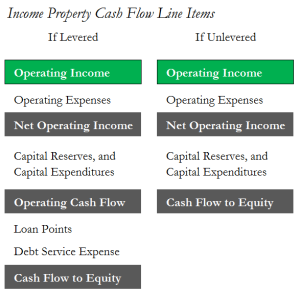

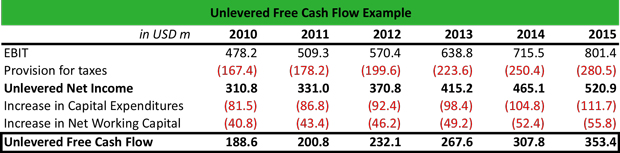

What Are Some Limitations of Levered and Unlevered Free Cash Flow? As such, they should both be considered when making financial decisions. It’s important to note that these are two different metrics that measure different aspects of your company. This metric can be useful for making investment decisions. On the other hand, unlevered cash flow is important because it shows how much cash a company would have if it didn’t have any debt. This metric is also useful for measuring a company’s financial health. Levered free cash flow is crucial to integrate because it shows how much cash a company has available to pay its debts. Levered and unlevered free cash flow is important for a variety of different reasons. Why Are Levered and Unlevered Free Cash Flow Important? After you subtract capital expenditures and interest expenses from operating cash flow, you’ll have unlevered free cash flow. Interest expense is the amount of money that a company pays in interest on outstanding debt. Capital expenditures are funds that a company spends on long-term investments. Operating cash flow is the cash that a company generates from its normal business operations. To calculate unlevered cash flow, you need to take into account three things: interest expense, operating cash flow, and capital expenditures. Not all business debt is bad, but it can certainly hold you back in the future if you do not manage it well.

0 kommentar(er)

0 kommentar(er)